deferred sales trust pros and cons

Pros And Cons Of Deferred Sales Trust posted Jan 7 2019 1034 PM by David Leiker updated Jan 7 2019 1034 PM by David Leiker updated. Reef Point was established as one of the few authorized Trustees in the US to create.

Restricted Property Trust A Pro Con White Coat Investor

Pros And Cons Of Deferred Sales Trust posted Jan 7 2019 1034 PM by David Leiker updated Jan 7 2019 1034 PM by David Leiker updated.

. In this video were going to take a look at the pros and cons of deferral sales trust. The deferred option provides a 6000 interest-free loan that is. Reef Point was established as one of the few authorized Trustees in the US to create Deferred Sales Trusts a shrewd and legal way to defer capital gains tax and reduce the overall tax.

This is an introduction to the deferred sales trust and how it compares to the 1031 exchange. Pros and Cons of the Deferred Sales Trust. Compare your matched advisors for fees specialties and more.

In the event of. Ad Schedule a call with a vetted certified financial advisor today. The primary benefit of deferred sales trusts is the.

If you own a highly appreciated asset that you wish to sell one of your main concerns likely is. Reef Point was established as one of the few authorized Trustees in the US to create Deferred Sales Trusts a shrewd and legal way to defer capital gains tax and reduce the overall tax. Deferred Sales Trust Pros and Cons.

Most of the clients also choose a. Sign up now at TD Ameritrade. The strength of the deferred sales trust is its flexibility and relatives all pressure to purchase a property via a short time frame using a 1031 exchange.

Deferred Sales Trust Pros and Cons Pros. This guide can show you how. Are you interested in becoming a deferred sales trust expert.

Reef Point LLC October 28 2021. A deferred payment agreement is a long-term loan you can request from your local authority if you own your home. Ad Protecting wealth requires knowing your financial picture.

We will explore why so many high net worth individuals are leveraging. The first and major disadvantage is that the Internal Revenue Service has not issued any guidance or rulings related to the Deferred Sales Trust at this point in time. This comprehensive guide can help you protect and extend your wealth.

The primary benefit of deferred. The primary benefit of deferred sales trusts is the ability to postpone capital gains taxes.

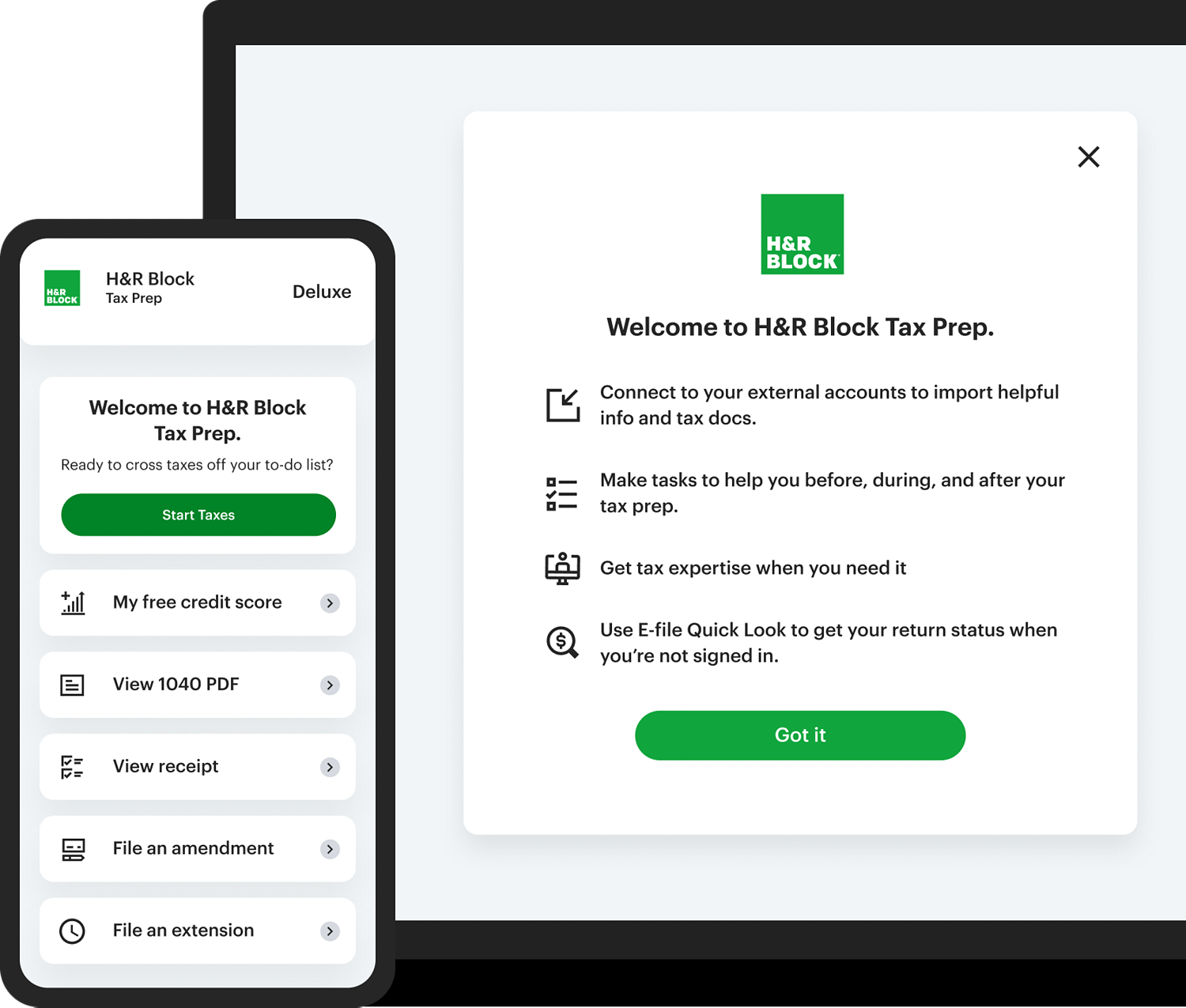

Deluxe Online Tax Filing E File Tax Prep H R Block

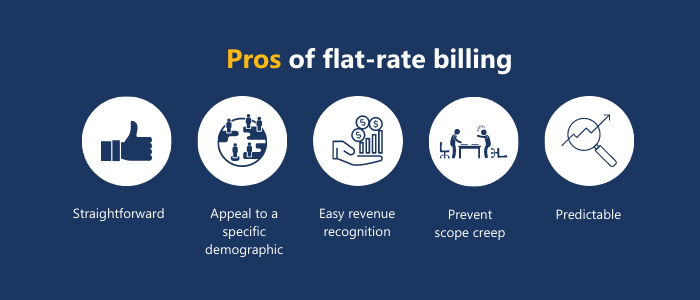

The Definitive Guide To Flat Rate Billing With Examples

Deferred Sales Trust 101 A Complete Guide 1031gateway

How A Delaware Statutory Trust Works Dst Investment

Pros And Cons Of Investing In A Delaware Statutory Trust

Charitable Gift Annuity Pros And Cons Blog Jenkins Fenstermaker Pllc

91 How To Defer Capital Gains With The Deferred Sales Trust With Brett Swarts Everything Real Estate Investing

The Pros And Cons Of Deferred Compensation The Business Journals

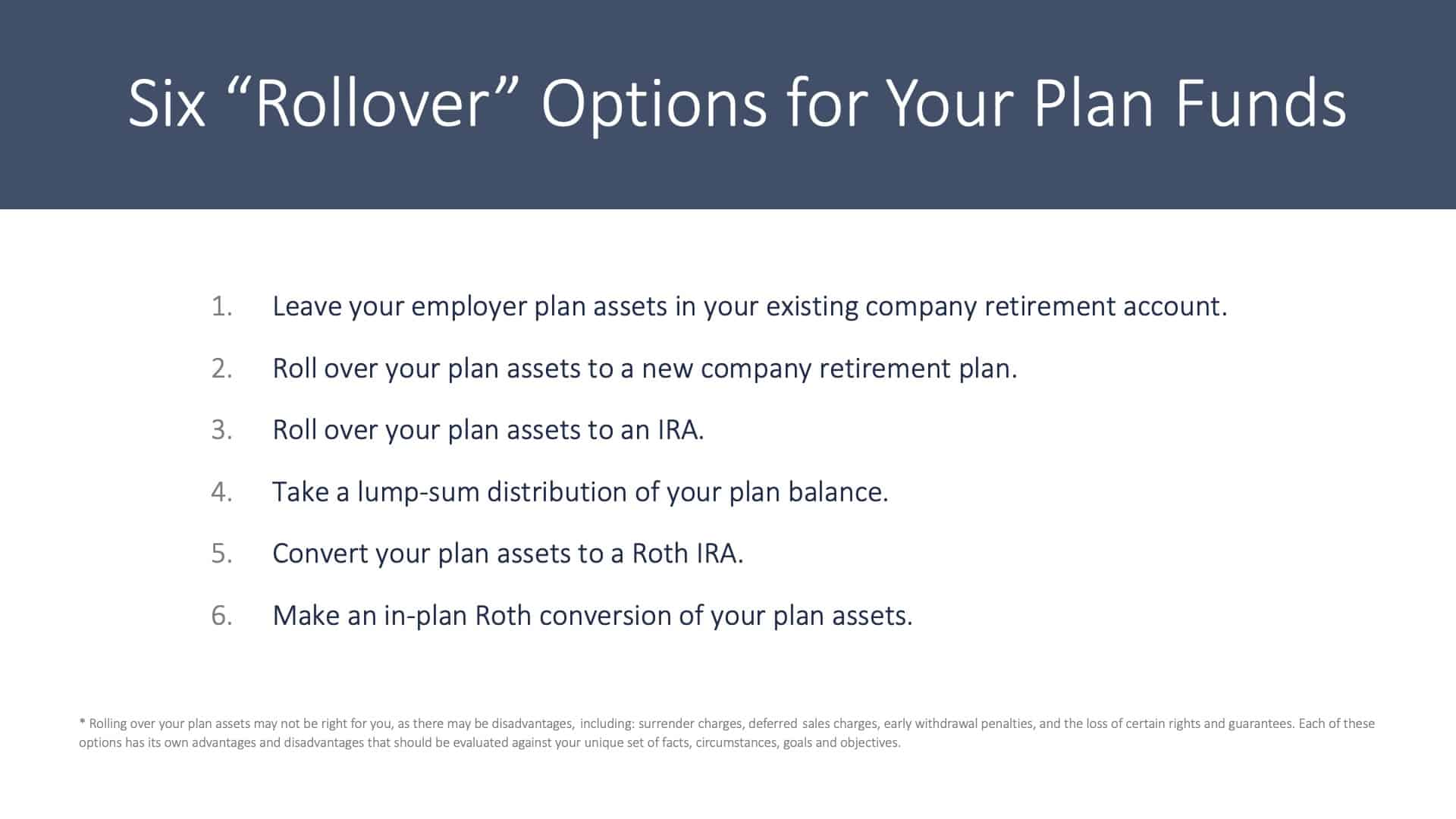

Savvy Ira Planning For Boomers Barber Financial Group

The Tale Of Two Dst S Delaware Statutory Trust Vs Deferred Sales Trust

What Are The Pros And Cons Of Offering Credit To Customers Universal Cpa Review

Deferred Sales Trust The Other Dst

Deferred Sales Trust Everything You Need To Know Life Bridge Capital

Tax Considerations When Selling Your Business Bessemer Trust

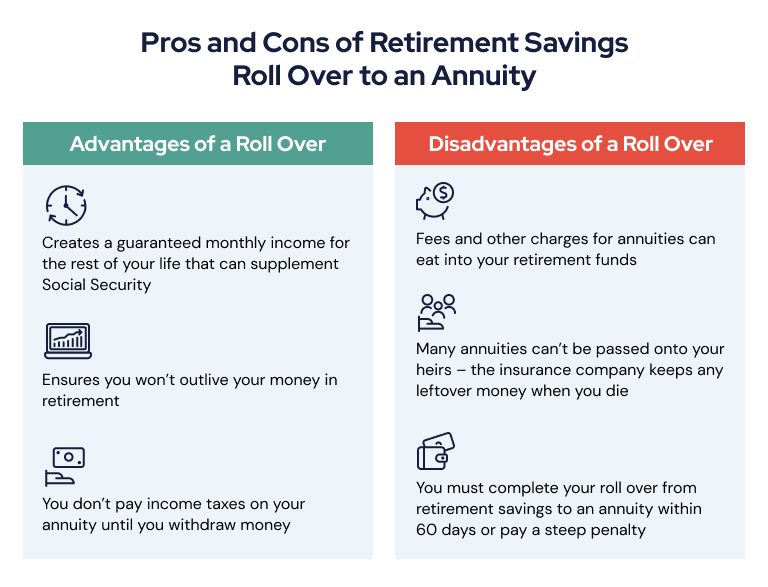

How To Roll Your Ira Or 401 K Into An Annuity

The Pros And Cons Of Opportunity Zone Funds For The Passive Investor

Deferred Sales Trust Everything You Need To Know Life Bridge Capital

Employee Ownership Trusts The Pros And Cons

Understanding The Pros And Cons Of A Self Canceling Installment Note Marcum Llp Accountants And Advisors