work in process inventory balance formula

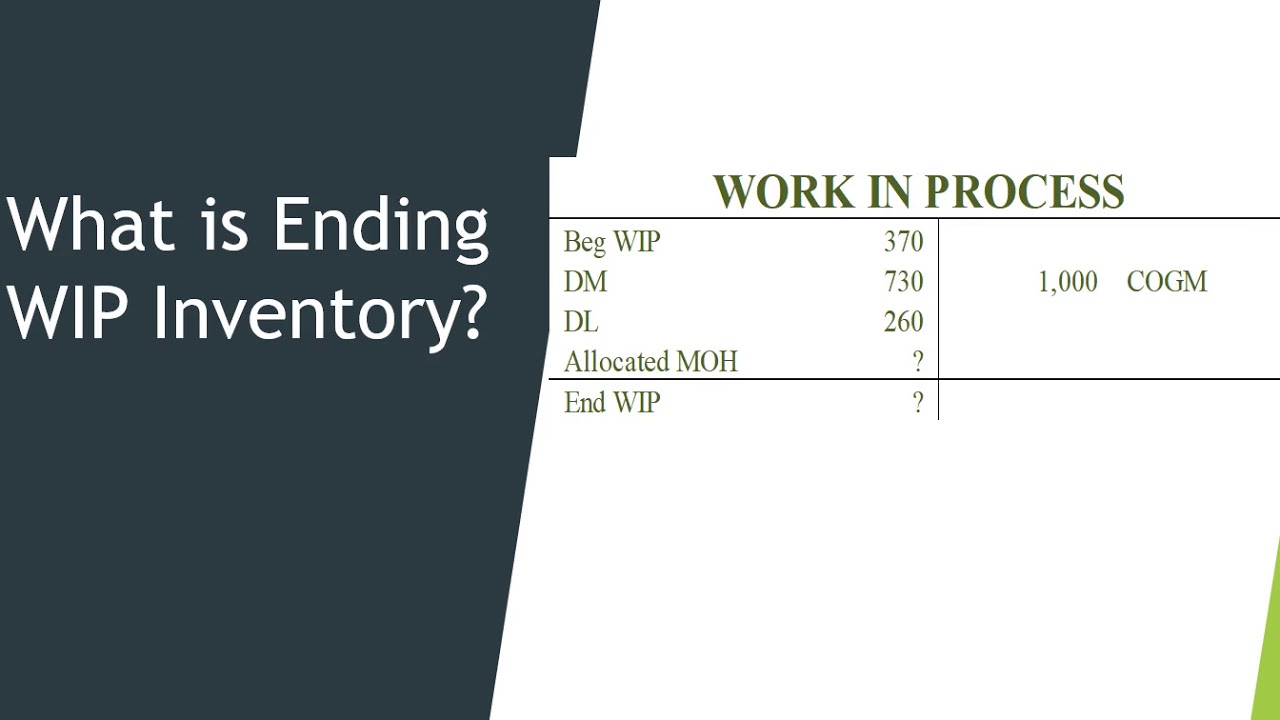

Ending WIP Beginning WIP Costs of manufacturing - costs of goods produced. The term work in process WIP inventory is widely spread and mainly used in the sphere of supply chain management.

Wip Inventory Definition Examples Of Work In Progress Inventory

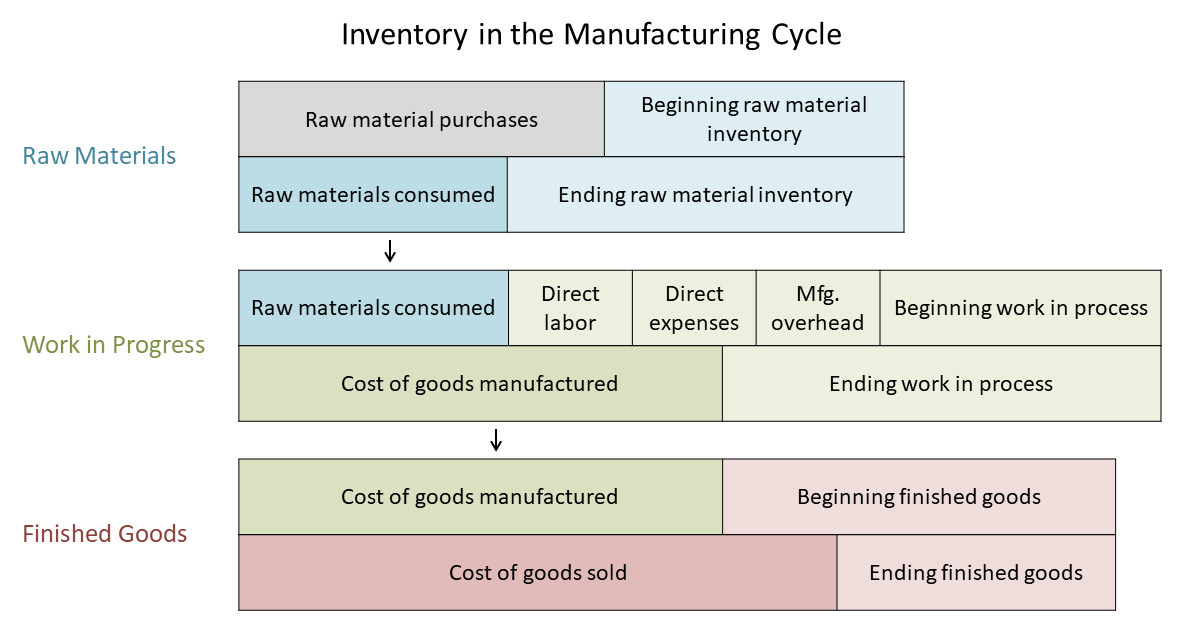

Adding the totals of these categories will give you your current work in process inventory.

. We have worked with thousands of students from all over the world. This means that Crown Industries has 10000 work in process inventory with them. Work In Process.

Work-in-process is inventory that has entered the production process but has not been completed at the balance sheet date. 10000 300000 250000 60000. I just need you to tell me the balance in the Work-in-Process Inventory Account so I can send it off to the.

WIP Inventory Example 2. The beginning WIP inventory cost refers to the previous accounting periods asset section of the balance sheet. A companys inventory usually includes items that they expect to sell in the next 12 months.

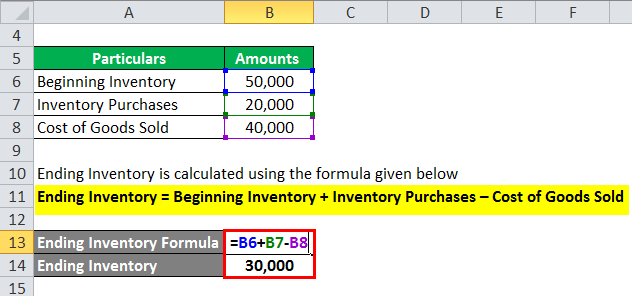

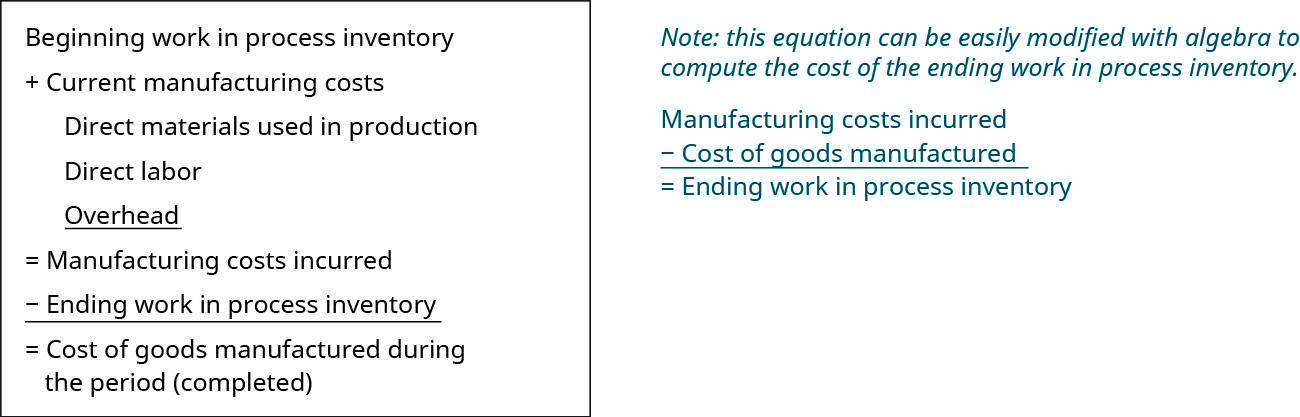

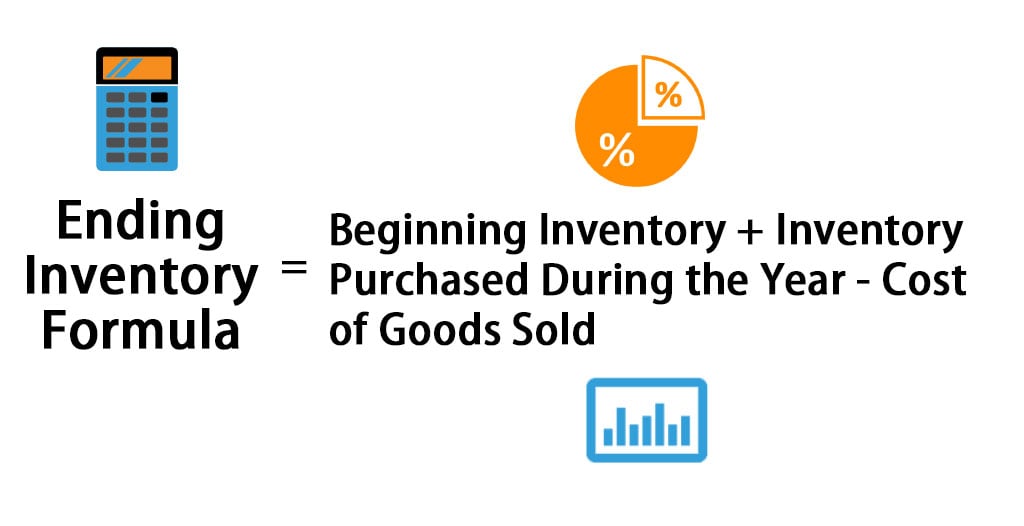

Ending Inventory Beginning Inventory Inventory Purchases Cost of Goods Sold. Ending WIP Inventory Beginning WIP Inventory Manufacturing Costs Cost of Finished Goods. These include raw materials finished goods and work-in-progress inventory.

Read more the first item purchased is the first item sold which means that the cost of purchase of the first item is the cost of the first item sold which results in closing. When youre calculating the WIP inventory for your balance sheets you will include manufacturing labor expenses and overhead costs in the final tally. The closing carrying balance is carried forward as the beginning balance for the next period.

Total Cost of Manufacturing Beginning Work in Process Inventory Ending Work in Process Inventory Cost of Manufactured Goods. Work-in-Progress Vs Work-in-Process Inventory. Higher sales and thus higher cost of goods sold leads to draining the inventory account.

Your WIP inventory formula would look like this. It relates to the overall costs of those goods that are non-finished yet or still in production. Ending Inventory Beginning Balance Purchases Cost of Goods Sold.

The WIP figure indicates your company has 60000 worth of inventory thats neither raw material nor finished goodsthats your work in process inventory. The calculation of ending work in process is. However by using this formula you can get only an estimate of the work in process inventory.

Work in process inventory includes all raw goods production expenses and labor costs associated with producing merchandise inventory. Beginning WIP Manufacturing costs - Cost of goods manufactured. It is why these assets fall under a companys current assets in the balance sheet.

The ending balance of inventory for a period depends on the volume of sales a company makes in each period. Ending WIP Inventory Beginning WIP Inventory Manufacturing Costs - Cost of Finished Goods. See how to calculate work-in-process inventory with the formula.

So to calculate ending inventory for the period we will start will the inventory which is currently listed on companys balance sheet. For the exact number of work in process inventory you need to calculate it manually. Work in process inventory 60000.

Beginning WIP Inventory Manufacturing Costs COGM Ending WIP Inventory. So to figure out how to find work in process inventory you need the beginning work in process inventory. Work in Progress WIP Formula.

The difference between the sum of the beginning work in process and the costs of manufacturing is the ending work in process. The beginning work in progress WIP inventory is the ending WIP balance from the prior accounting period ie. There are things it doesnt consider like waste spoilage downtime scrap and MRO inventory.

Take a look at how it looks in the formula. Determining the balance of Inventory. The work in process formula is.

Any inventory that moves from raw materials and is manipulated by human or machine labor but is not yet a complete product is considered to be work-in-process inventory. Ending Work in Progress WIP Beginning WIP Manufacturing Costs Cost of Goods Manufactured. In this case for example consider any manufactured goods as work in process.

Add the new purchases and subtract the Cost of goods sold. As determined by previous accounting records your companys beginning WIP is 115000. During the year 150000 is spent on manufacturing costs along with your total cost of finished goods being 205000.

And to calculate that you need the ending work in process inventory. How to Calculate Ending Work In Process Inventory. Work in Process Inventory Formula Therefore the formula from which a business can calculate their COGM using work in process inventory costs can be displayed like this.

Ending work in process. Keep in mind this value is only an estimate. Once all of the above variables are determined the formula to calculate the WIP inventory is as below.

The formula for this is as follows. Usually companies calculate a percentage of completed work to separate these items from others. The amount of ending work in process must be derived as part of the period-end closing process and is also useful for tracking the volume of production activity.

WIP inventory is a vital production step that is considered an asset on a companys balance sheet. WIP is calculated as a sum of WIP inventory total direct labor costs and allocated overhead costs. 8000 240000 238000 10000.

How To Calculate Finished Goods Inventory

All You Need To Know About Wip Inventory

Inventory Formula And Calculator Excel Template

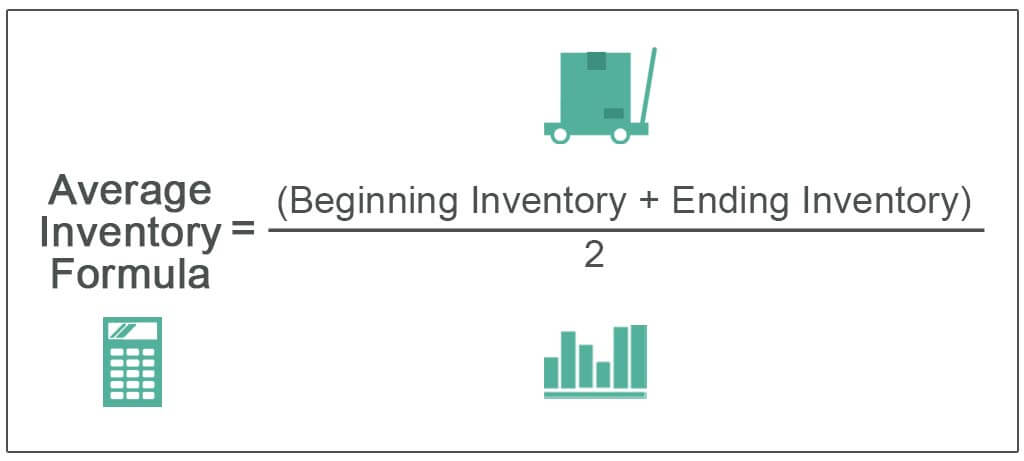

Average Inventory Formula How To Calculate With Examples

What Is Inventory Turnover Inventory Turnover Formula In 3 Steps

Work In Progress Wip What Is It

Work In Process Inventory Formula Wip Inventory Definition

Beginning Work In Process Inventory Business Accounting

Inventory Formula Inventory Calculator Excel Template

Work In Progress Wip Definition Example Finance Strategists

Work In Process Wip Inventory Youtube

Ending Inventory Formula Calculator Excel Template

Cost Of Goods Manufactured Formula Examples With Excel Template

Manufacturing And Non Manufacturing Costs Online Accounting Tutorial Questions Simplestudies Com

Cost Of Goods Manufactured Formula Examples With Excel Template